Ban on cryptocurrency still in force – Finance Ministry warns

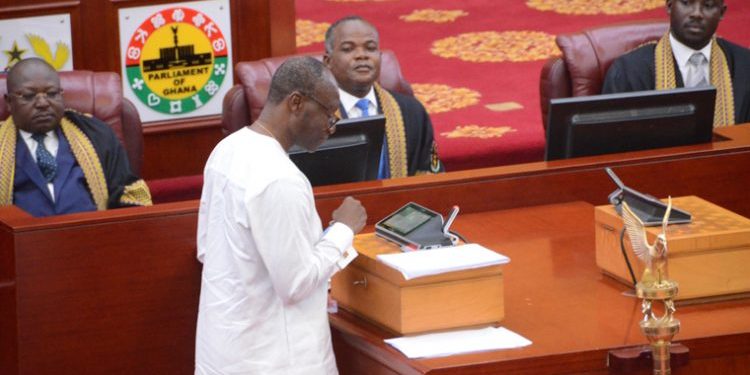

The government has reiterated its ban on the use of cryptocurrency in all transactions, saying that all financial institutions in the country have been directed not to engage in crypto transactions. Minister of State at the Finance Ministry, Dr. Mohammed Amin Adam, made the announcement when he answered questions on the floor of Parliament. “The […]

Ban on cryptocurrency still in force – Finance Ministry warns Read More »