News

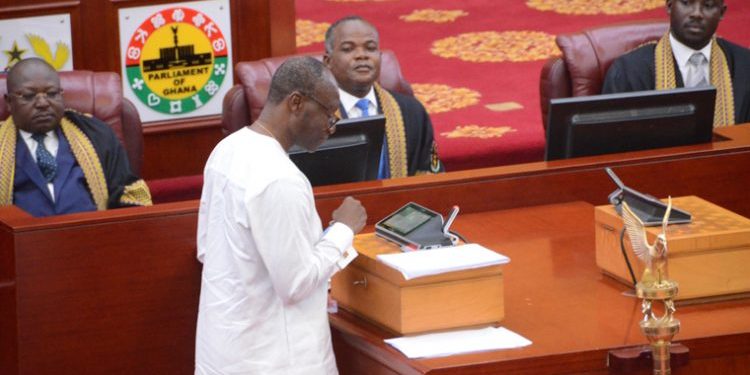

Finance Minister to engage MPs ahead of mid-year budget review

The Finance Minister, Ken Ofori-Atta is expected to have an intensive engagement with Members of Parliament today, July 28, ahead of the presentation of the mid-year budget review next week.

Read MoreGhana’s oil revenue drops to US$540m in first half of 2023

Ghana has recorded a total of US$540 million in petroleum receipts during the first half of 2023, as reported by the Petroleum Holding Fund report released by the Bank of Ghana, which provides insights into the Fund’s performance.

Read MoreStandard Chartered posts strong income growth in 2022; affirms commitment to Ghana

Standard Chartered Bank Ghana PLC has held its 53rd Annual General meeting to present the Annual Report and Financial Statements for the year ended 31 December 2022 to its shareholders.

Read MoreDDEP: Govt extends invitation for Ghc31bn pension funds

Government has commenced an alternative offer for pension funds exchange inviting holders of domestic notes and bonds of the central government, E.S.L.A Plc and Daakye Trust Plc. The government is seeking to exchange approximately, GHS 31 billion principal amount of the eligible bonds for a package of new bonds. “This invitation is intended to enable […]

Read MoreMenzgold to pay customers after completion of validation exercise

Defunct gold trading company, Menzgold has announced that it has successfully completed the transaction validation process assuring to make payments to its customers soon. This was contained in a statement issued by the management of Menzgold dated July 29. “Following the gold trading transactions claims supporting documents collection and vetting exercise initiated; we are happy […]

Read MoreRising inflation forces monetary policy tightening; rate up by 0.5 to 30 percent

The Bank of Ghana (BoG) has tightened the monetary policy rate by 50 basis points, pushing it up to 30 percent. This was determined following the apex bank’s review of economic trends in the last two months. This means the cost of borrowing at banks has risen by 0.5 percent from the previous rate of […]

Read MoreSavings and loans companies receive assurance from BoG to resolve NPLs

Savings and loans companies in the country have received assurances from the central bank that steps will be taken to resolve difficulties with Non-Performing Loans (NPLs) and high interest rates. The Central Bank claims to have seen the difficulties facing the sector’s operators. As the bank continues to work to ensure financial stability, Mr. Osei […]

Read MoreBan on cryptocurrency still in force – Finance Ministry warns

The government has reiterated its ban on the use of cryptocurrency in all transactions, saying that all financial institutions in the country have been directed not to engage in crypto transactions. Minister of State at the Finance Ministry, Dr. Mohammed Amin Adam, made the announcement when he answered questions on the floor of Parliament. “The […]

Read MoreSubscribe Now

Don’t miss our future updates! Get Subscribed Today!